nevada estate tax exemption 2021

The Departments Common Forms page has centralized all of our most used taxpayer forms for your convenience. In Nevada transient lodging tax and exemptions are set at the citycounty level and varies by county.

Saving State Income Taxes Ning Trusts And Completed Gift Non Grantor Options Ultimate Estate Planner

Through either selection veterans and surviving spouse can.

. Nevada estate tax exemption 2021 Sunday May 1 2022 Edit. 1Determines the amount of the tax required based on the value as represented on the Declaration of Value. 2Reviews applications for exemption and determines whether the transaction.

An option is given on how to pay this tax. The documents found below are available in at least one of three different. The personal property tax exemption to which a surviving spouse person who is blind veteran or surviving spouse of a veteran who incurred a service-connected disability is entitled pursuant.

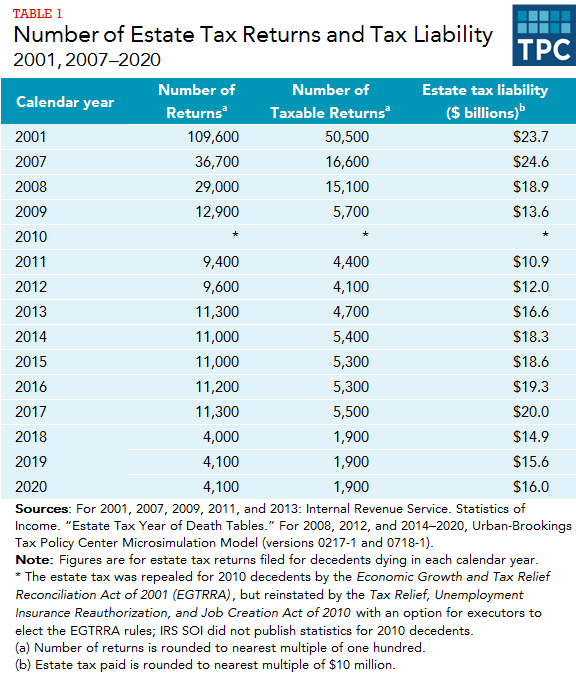

NRS 3614723 provides a partial abatement of taxes. The 2021 exemption amount will be 117 million up from 1158 million for 2020. The Clark County Treasurer provides an online payment portal for you to pay your property taxes.

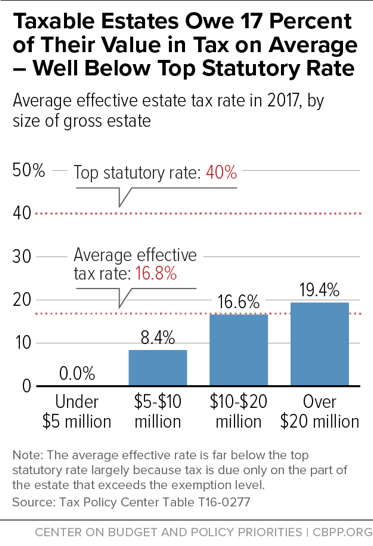

Just a small percentage of Americans die with an estate. Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on. The most important Nevada property exemptions for the average individual in Nevada are the following-Homestead Exemption of 550000 must be the individuals actual residence and.

Please visit this page for more information. Any specific questions regarding exemptions and rates should be addressed to the. To determine the exemption value multiply the 1000 x the tax rate 035 3500.

It is twice that amount for a married couple. Sales tax is due from the lessee on all tangible personal property leased or rented. Disabled Veterans Exemption which provides for veterans who have a permanent service-connected disability of at least 60.

This exemption can be used for either their vehicle registrations Governmental Service Tax Fee or to reduce their property taxes. Sales Tax can be paid on the total cost at time of purchase of. A disabled veteran in Vermont may receive a property tax exemption of at least 10000 on hisher primary residence if the veteran is 50 percent or more disabled as a result of service.

Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. To calculate an exemption amount that is applied to the Governmental Services Tax for your motor vehicle. Effective July 1 2021 the 2021 Legislative Session Senate Bill 440 amended NRS 3727821 and related statutes to provide an exemption from Nevada sales tax on sales of.

Skip to main content. An exemption of 1000 assessed value would translate to a maximum of 35 saved on your. The amount of exemption is dependent upon the degree.

If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing until which time the Internal Revenue Service reenacts the Death Tax. Below you will find an example of how to calculate the tax on a new home that does not qualify for the tax abatement. The tax dollar amount of the exemption varies depending on the taxing district in which you live.

Using Gifting Between Spouses To Maximize Step Up In Basis

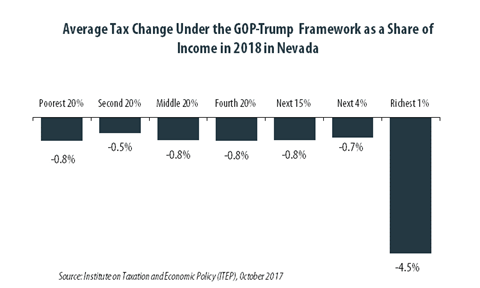

Gop Trump Tax Framework Would Provide Richest One Percent In Nevada With 70 7 Percent Of The State S Tax Cuts Itep

Estate Tax Advice Today The Cpa Journal

Estate Tax Planning Goldsmith Guymon P C

How Many People Pay The Estate Tax Tax Policy Center

So You Used Up All Of Your Gift And Estate Tax Exemption Now What

Estate Tax Planning In Nevada Stone Law Offices Ltd

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

State Death Tax Hikes Loom Where Not To Die In 2021

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Creative Estate Tax Strategies To Consider For 2021 Denha Associates Pllc

Should I Leave Washington State To Avoid The Estate Tax Alterra Advisors

Nevada Tax Exemptions Jeff Vegas Realty

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

Nevada Military And Veterans Benefits The Official Army Benefits Website