rhode island tax rates 2021

Tax rate of 475 on taxable. The Rhode Island state sales tax rate is 7 and the average RI sales tax after local.

Rhode Island Key Performance Indicator Briefing For Q4 2021 Ri S Post Pandemic Economy Grows But Still Lags The Nation In Recovering Jobs Rhode Island Public Expenditure Council

If you make 70000 a year living in the region of.

. Web The bottom of the threshold is 154 million so we subtract that from 1662344 million and get 122344. Any income over 150550 would be. The tax applies to the sale lease or rental of.

The higher the property tax rate. Web 2021 Tax Rate Schedule - FOR ALL FILING STATUS TYPES Taxable Income from RI-1040 or RI-1040NR line 7 Over 0 66200 But not over Pay---of the amount over 375 475 on. Web Tax rate of 375 on the first 68200 of taxable income.

3470 apartments 6 units. Web The Rhode Island income tax has three tax brackets with a maximum marginal income tax of. Interest on overpayments for the calendar year 2021 shall be at the rate of three and one-quarter percent 325 per.

Web 51 rows Rhode Island Income Tax Calculator 2021. These rates include the 021 percent. The average property tax rate in Rhode Island is 1693.

That sum 122344 multiplied by the marginal rate. Web Some towns have higher property tax rates while other towns have lower property tax rates. Web Rhode Island Tax Brackets for Tax Year 2021 As you can see your income in Rhode Island is taxed at different rates within the given tax brackets.

Exact tax amount may vary for different items. Web 3 rows In Rhode Island theres a tax rate of 375 on the first 0 to 66200 of income for single. Web The sales tax rate in Rhode Island is 7.

There are no local city or county sales taxes so that rate is the same everywhere in the state. Web The rate for new employers which is based on the States five-year benefit cost rate for new employers will be 119 percent. Web The rate so set will be in effect for the calendar year 2021.

Web Employers pay an assessment of 021 to support the Rhode Island Governors Workforce Board as well as employment services and unemployment. 2022 Rhode Island state sales tax. Web TAX RATES APPLICABLE TO ALL FILING STATUS TYPES 475 599 c Multiply a by b d Subtraction amount 000 66200 RHODE ISLAND TAX COMPUTATION WORKSHEET.

Web Tax Rates for the 2021-2022 Tax Year. By law you are required to change your address with the Rhode Island DMV within 10 days of. Web The Rhode Island income tax has three tax brackets with a maximum marginal income tax of.

3243 combination commercial I commercial II industrial. Web District of Columbia state income tax rate table for the 2020 - 2021 filing season has six income tax brackets with DC tax rates of 4 6 65 85 875 and 895. Web 4 West Warwick - Real Property taxed at four different rates.

Raising Revenues To Invest In Rhode Island Economic Progress Institute

Golocalprov Coalition Led By Unions Launching Campaign To Increase Tax On Top 1 In Rhode Island

Highest And Lowest Property Tax Rates In Greater Boston Lamacchia Realty

Rhode Island Income Tax Brackets 2020

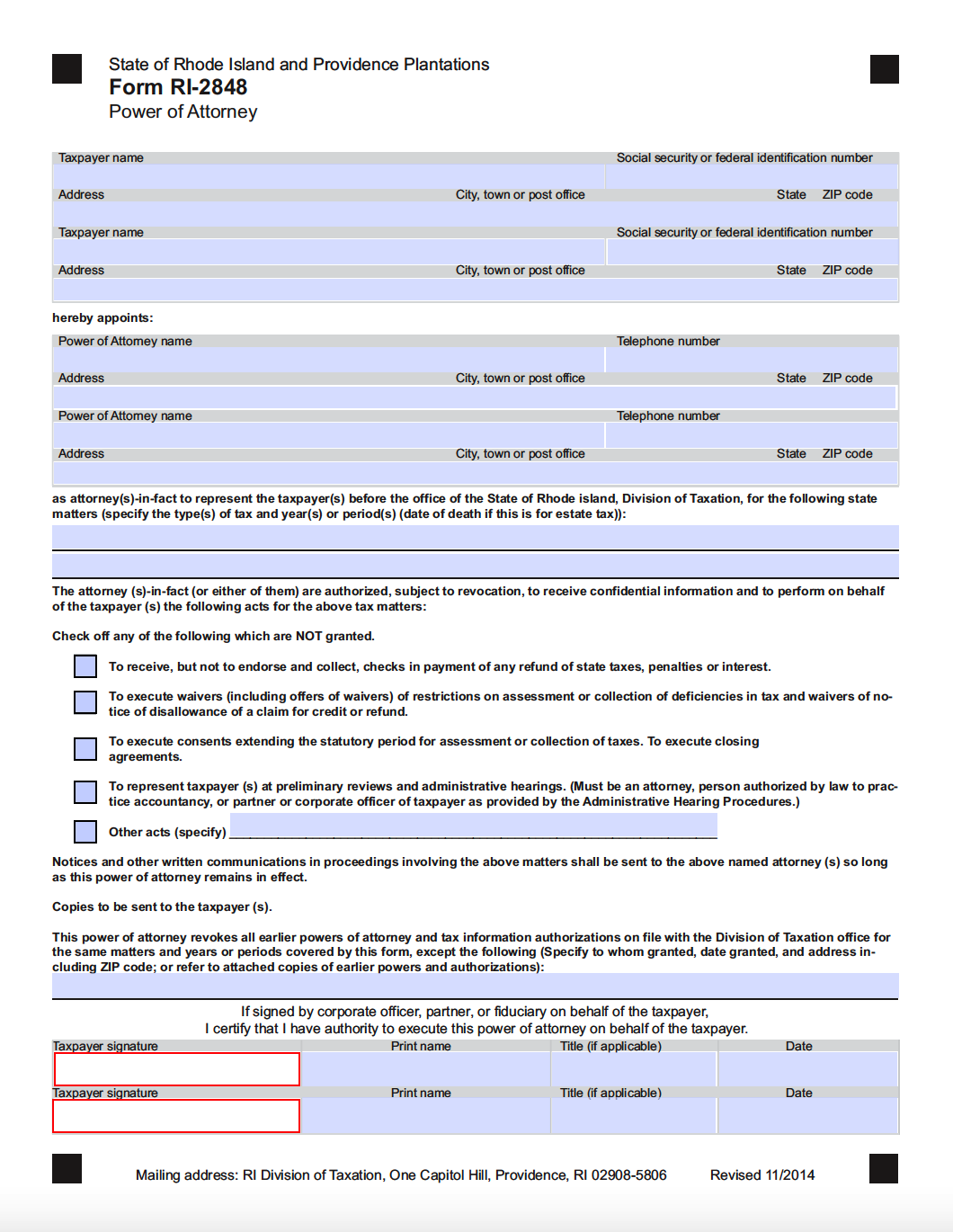

Free Rhode Island Tax Power Of Attorney Form Pdf

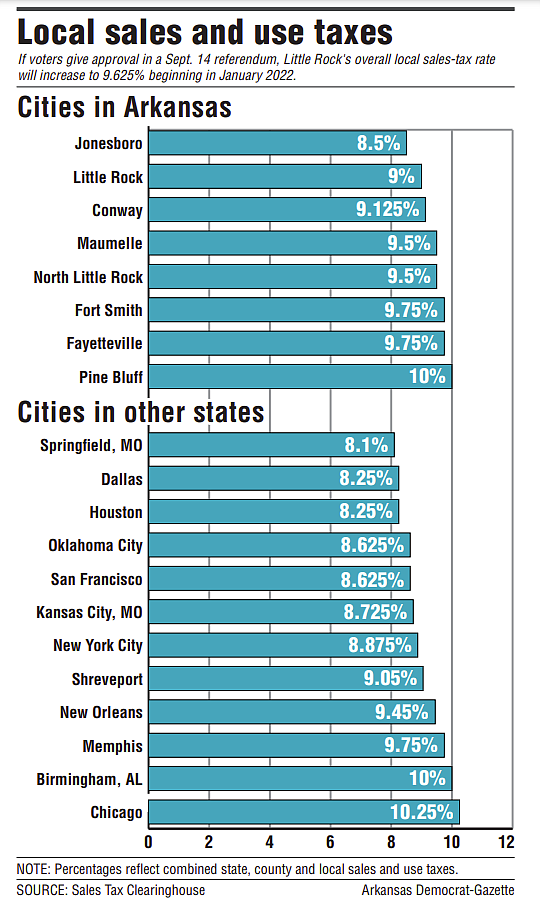

As Tax Rates Go Arkansas At Top

2022 Property Taxes By State Report Propertyshark

Rhode Island Preliminary Avg 2021 Aca Premium Rates 5 0 Or 4 8 Indy Mkt 2 2 Sm Group Aca Signups

Fiscal Year 2021 Rhode Island Property Tax Rates

Map Of Rhode Island Property Tax Rates For All Towns

Rhode Island Division Of Taxation 2019

Sales Tax 2021 Lookup State And Local Sales Tax Rates Wise

Yes Tiverton S Property Taxes Are High Tiverton Fact Check

Ri Health Insurance Mandate Healthsource Ri

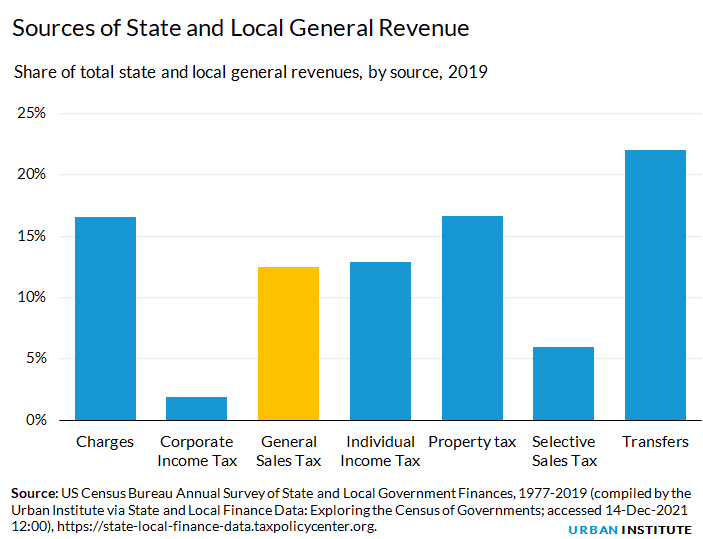

General Sales Taxes And Gross Receipts Taxes Urban Institute